The Complete CreditRepair.com Review 2024

CreditRepair.com is a credit repair company helping people improve their credit scores for over 20 years. The company offers various services, including credit report analysis, dispute management, and creditor negotiations. This CreditRepair.com review will illustrate the pros, cons, and other details to be aware of when going through the credit repair process.

Credit repair is disputing inaccurate or outdated information on your credit report. Improving your credit score can simplify obtaining credit cards, loans, and other types of credit.

The Fair Credit Reporting Act (FCRA) gives you the right to dispute inaccurate information on your credit report. You can dispute information yourself or hire a credit repair company to do it for you.

You must send a letter to the credit bureau(s) reporting the inaccurate information to dispute information on your credit report. The letter should include the following information:

- Your name, address, and Social Security number

- The name of the creditor or debt collector that is reporting the inaccurate information

- The specific information that you are disputing

- Why do you believe the information is inaccurate?

- To support your assertion, provide proof, such as a payment receipt or a letter from the creditor confirming that the debt has been settled.

The credit bureau(s) have 30 days to investigate your dispute. They must remove the information from your credit report if it needs to be updated. They will not remove the information from your credit report if they find it accurate.

You can dispute information on your credit report as many times as necessary. Avoid too many disputes, as this can damage your credit score.

It is also important to note that credit repair is a challenging fix. It can take time to dispute inaccurate information and improve your credit score. However, if you are patient and persistent, you can improve your credit score and get the necessary credit.

Here are some additional things to keep in mind about credit repair:

- There are many scams, so choose a reputable credit repair company.

- You can do credit repair yourself, but it can be time-consuming and difficult.

- Credit repair can have negative consequences, such as damaging your relationship with your creditors.

If you are considering credit repair, I recommend speaking to a financial advisor or credit counselor to get more information.

Pros of CreditRepair.com

A+ rating with the Better Business Bureau: The Better Business Bureau has given CreditRepair.com the highest possible rating of A+. This means that the company has been rated highly by its customers and has a good record of resolving complaints.

- Thousands of positive customer reviews: CreditRepair.com has received abundant positive feedback on its website and various review platforms. These reviews indicate that the company is providing a good service and that its customers are satisfied with the results.

- Proven track record of success: Many individuals have succeeded in boosting their credit scores through the assistance of CreditRepair.com’s reliable and effective services. The company claims its customers have seen an average increase of 625 points in their credit scores after using its services.

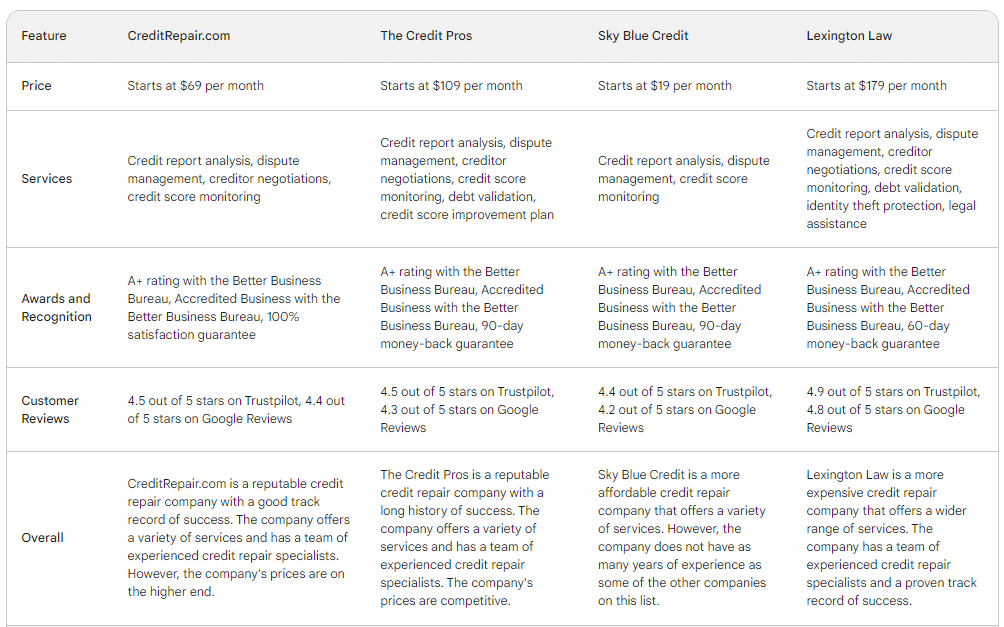

- Affordable prices: CreditRepair.com offers a variety of pricing plans to fit different budgets. The company’s most basic plan starts at $69 per month.

- Easy-to-use website and software: CreditRepair.com has a user-friendly website and software that makes tracking your progress and managing your account easy.

- Dedicated customer support: If you have any questions or concerns about your credit, know that CreditRepair.com has friendly and knowledgeable staff members who can assist you. They are dedicated to providing you with exceptional customer support and helping you overcome any obstacles you may face along the way.

Cons of CreditRepair.com

- There have been reports of customers expressing concerns about the duration it takes to witness positive outcomes: Some customers have complained that it takes CreditRepair.com a long time to see results. The company claims it can take up to 6 months to see significant results, but some customers have reported waiting longer.

- The company does not offer a money-back guarantee: CreditRepair.com does not offer a money-back guarantee. This means that you are taking a risk by signing up for the company’s services.

- There are some hidden fees: CreditRepair.com has some hidden fees, such as a setup fee and a monthly maintenance fee. These fees can add up, so read the fine print before signing up for the company’s services.

- Credit repair can be time-consuming and frustrating: Credit repair is not a quick fix. Correcting any errors on your credit report and working to improve your credit score can be a process that requires both patience and dedication.

Tips for Choosing a Credit Repair Company

- Check the company’s accreditation: The company should be accredited by the Better Business Bureau (BBB) or another reputable organization.

- Read reviews from other customers: This can help you understand the company’s reputation and the quality of its services.

- Compare prices: Credit repair can be expensive, so compare prices from different companies before deciding.

- Ask about the company’s fees: Make sure you understand all the fees that the company charges, including upfront fees, monthly fees, and hidden fees.

- Get everything in writing: Make sure you get all of the terms of the agreement in writing, including the company’s fees, its dispute process, and its refund policy.

- Beware of scams: There are many scams out there, so be careful not to fall victim to one. Be alert for companies that promise quick results or charge high upfront fees.

Here are some additional things to keep in mind:

- Please do your research: Before choosing a credit repair company, it is essential to do your research. This includes reading reviews, comparing prices, and understanding the company’s fees and policies.

- Be patient: Credit repair takes time. It can take several months or even years to see significant results.

- Be persistent: Remain persistent when disputing inaccurate information on your credit report. Keep going if you see results right away.

The Risks of Credit Repair

- The company may need help to remove all the inaccurate information from your credit report. The Fair Credit Reporting Act (FCRA) only requires credit bureaus to remove accurate information from your credit report if it is incomplete or obsolete. If the information on your credit report is correct, the credit bureau is not required to remove it.

- The company may charge high fees. Credit repair can be expensive, so understand all the costs the company charges before signing up for their services.

- The company may not be legitimate. There are many scams, so do not fall victim to one. Look out for companies that promise quick results or charge high upfront fees.

- The company may damage your credit score. If the company does not handle your dispute correctly, it could further damage your credit score. Work with a reputable company that knows the law and has experience in credit repair.

Before using a credit repair company, research and select a reputable company with a proven track record. It would help if you were prepared to put in the time and effort necessary to improve your credit score.

Here are some additional things to keep in mind:

- Be careful not to give the company your personal information, such as your Social Security number or bank account information. This information could be used to commit identity theft.

- Be wary of upfront fees. Legitimate credit repair companies typically do not charge upfront fees.

- Get everything in writing. Ensure you get all of the terms of the agreement in writing, including the company’s fees, dispute process, and refund policy.

CreditRepair.com is a reputable credit repair company with a good track record of success. The company offers affordable prices, easy-to-use software, and dedicated customer support. Unfortunately, there’s no certainty that CreditRepair.com will improve your credit score. Credit repair success depends on several factors, including the severity of the errors on your credit report and your willingness to follow the company’s instructions.

Ammar has started several online businesses and is a blogger who loves providing quality content to help others. He is involved with affiliate marketing, domain names, NFTs, and cryptocurrencies. Check out my blog if you want to learn more about these areas and business in general.