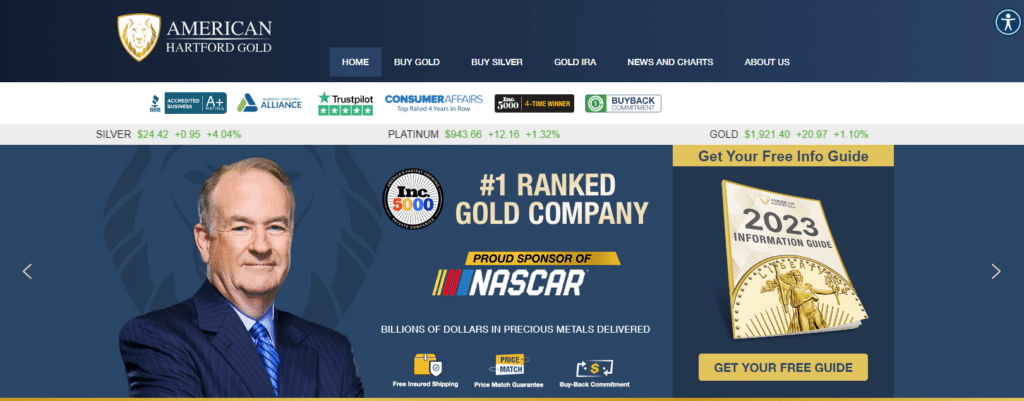

American Hartford Gold Review 2024

Are you considering investing in a gold IRA? If so, you may be wondering about American Hartford Gold. In this American Hartford Gold Review, we will take a closer look at the company and provide an analysis of their services.

Affiliate Disclaimer: I receive a commission if you purchase any products or services through my links on this blog post.

American Hartford Gold is a company that focuses on precious metals investment, particularly in gold and silver IRAs. It was established in 2015 by two investors, Sanford Mann and Scott Gerlis, who both have extensive experience in the field and share a deep passion for precious metals. The company is based in California and has thrived since its inception.

A gold IRA is an individual retirement account (IRA) that allows you to invest in physical gold, silver, or other precious metals. To open a gold IRA, you must open a self-directed IRA with a custodian, such as American Hartford Gold. The custodian will then hold your precious metals in secure storage.

American Hartford Gold can help you set up a gold IRA by providing you with the following services:

- Free consultation with a precious metals specialist

- Help with choosing the proper custodian

- Help with transferring your existing IRA into a gold IRA

- Help with buying and storing your precious metals

Visit their website here to set up a gold IRA.

Benefits of Investing in a Gold IRA

- Tax-deferred growth: By investing in a gold IRA, your money can grow without being taxed on any capital gains until you withdraw it during your retirement years. You can maximize your savings and prepare for a financially secure future.

- Diversification: Gold is a non-correlated asset, which means it does not move like stocks and bonds. Diversifying and mitigating your risk can prove to be wise.

- Inflation protection: One of the benefits of owning gold is that it can serve as a form of protection against inflation. Historically, the value of gold tends to rise as the prices of goods and services increase.

Risks of Investing in a Gold IRA

- Volatility: Investing in gold can be a challenge as its value can fluctuate rapidly, which brings about risks for some investors.

- Storage costs: As a precious metals investor, it’s important to remember that storage fees may apply to your holdings. The amount you’ll need to pay can vary depending on the custodian you select.

- Insurance costs: You may also need insurance for your precious metals to protect you in case of loss or theft.

Pros of American Hartford Gold

- A+ rating with the Better Business Bureau: Based on feedback from over 400 customers, American Hartford Gold has received an outstanding A+ rating from the Better Business Bureau. The company has a good track record of customer satisfaction.

- Thousands of positive reviews: Many customers have praised American Hartford Gold for its top-notch customer service, competitive pricing, and diverse selection of precious metals.

- Lowest Price Guarantee and no buy-back fees: American Hartford Gold offers the Lowest Price Guarantee on all its precious metals. You are guaranteed the lowest price on gold or silver from the company. American Hartford Gold also does not charge any buy-back fees, meaning you can sell your precious metals back to the company at any time without incurring additional costs.

- Free consultation with a precious metals specialist: American Hartford Gold offers a free consultation with a precious metals specialist to help you learn more about investing in gold and silver. Exploring precious metals as an investment option is a wise decision that can provide you with additional opportunities. It’s a great starting point to embark on your path to financial expansion.

- Featured on reputable news outlets: American Hartford Gold has been recognized by esteemed news sources like Fox News and The Wall Street Journal. The company is considered a reputable and trustworthy source of information about precious metals.

Overall, American Hartford Gold is a reputable company that offers various services to help investors protect and grow their wealth by purchasing physical precious metals. American Hartford Gold is an excellent option if you are considering investing in a gold IRA.

However, doing your research before making any investment decisions is crucial. There are many factors to consider when investing in precious metals, such as your investment goals, risk tolerance, and time horizon. You should also consult with a financial advisor to get personalized investment advice.

Cons of American Hartford Gold

Here are some of the cons of American Hartford Gold:

- Some customers have complained about high fees: Some customers have complained about the high costs associated with American Hartford Gold’s services. These fees include account opening, storage, and insurance fees.

- No product prices on the website: American Hartford Gold does not list product prices, and it can be difficult for customers to compare prices and make informed investment decisions.

- Platinum and Palladium Products Not Online: American Hartford Gold needs to list them on its website, which could be a way to lose out on potential customers interested in these precious metals.

- No shipping outside of the U.S.: American Hartford Gold does not ship its products outside the United States. This could be a drawback for investors not located in the United States.

Here are some additional things to keep in mind when considering investing with American Hartford Gold:

- The company is not a financial advisor: American Hartford Gold is not a financial advisor and cannot provide personalized investment advice. Before investing in precious metals, consult a financial advisor for customized investment advice.

- Investing in precious metals is a risky investment: Investing in precious metals is a risky investment. Investing in gold and other precious metals can be risky, as their value is subject to fluctuation, and you may experience a loss on your investment.

- Invest money you can afford to lose: It’s important to be aware that investing in precious metals comes with a certain level of risk, so it’s wise only to invest funds that will avoid financial strain if lost.

Based on your provided information, I recommend you research before deciding whether or not to use American Hartford Gold. The company has a good track record of customer satisfaction, but there are some cons to consider, such as the high fees and the need for product prices on the website. Make sure to weigh the pros and cons carefully before deciding.

Here are some things to consider when making your decision:

- Your investment goals: What goals do you consider for investing in precious metals? Are you looking for a haven investment to protect your wealth from inflation? Or are you looking for an investment that has the potential to grow in value over time?

- Your risk tolerance: How much risk are you comfortable taking with your investment? Precious metals are a relatively safe investment but can also be volatile.

- Your time horizon: How long will you hold onto your investment? If you plan to sell your investment in the short term, consider a different asset.

- Your budget: How much money are you planning to invest? American Hartford Gold has a minimum investment of $10,000 for gold IRAs.

If you decide to use American Hartford Gold, I would recommend that you:

- Get a free consultation with a precious metals specialist to learn more about the company’s services and products.

- Compare the company’s fees to other companies offering similar services.

- Read reviews from other customers to get an idea of their experiences with the company.

- Ultimately, the decision of whether or not to use American Hartford Gold is up to you. This information has been helpful.

Tips for investing in precious metals

- Please do your research: Before investing in any precious metal, study and understand the market. Understand the different types of precious metals, their history, and their current prices.

- Consider your investment goals: What are you hoping to achieve by investing in precious metals? Are you looking for a haven investment to protect your wealth from inflation? Or are you looking for an investment that has the potential to grow in value over time?

- Determine your risk tolerance: How much risk are you comfortable taking with your investment? Precious metals are a relatively safe investment but can also be volatile.

- Set a budget: How much money are you planning to invest? Precious metals can be costly, so set a budget and stick to it.

- Choose a reputable dealer: Before purchasing precious metals, it is important to select a trustworthy dealer. Review online feedback or seek advice from loved ones.

- Store your metals safely: After obtaining your precious metals, it is crucial to store them securely. Recommended storage options include a safe deposit box, a home safe, or a reputable storage facility. Ensuring their safety will give you peace of mind and protect your investment for the long term.

- Diversify your portfolio: Investing in various assets, including precious metals, is a good idea. You can reduce your risk if the value of one asset declines.

The Risks of Investing in Precious Metals

There are several risks associated with investing in precious metals, including:

- Price volatility: The price of precious metals can fluctuate wildly, meaning you could lose money on your investment.

- Storage costs: You must pay storage fees for your precious metals. These fees can vary depending on the type of metal and the location of the storage facility.

- Insurance costs: You may also need insurance for your precious metals to protect you in case of loss or theft.

- Liquidity: Selling precious metals may pose a challenge, particularly if you urgently need to do so.

- Counterparty risk: Investing in precious metals through a dealer may result in counterparty risk. As a result, you could lose your investment if the dealer goes bankrupt.

- Tax implications: When you sell precious metals, you may have to pay capital gains taxes. The taxes you’ll need to pay are based on the profit you earn from the sale.

If you want to learn more about investing in precious metals or opening a gold IRA, don’t hesitate to contact American Hartford Gold. If you need guidance in making the right financial decision, the company has a team of skilled professionals ready to assist you and provide the information you need to make an informed choice. You can reach American Hartford Gold by calling 1-800-997-2727 or visiting their website here.

Note: Please note that the content shared in this post is not intended to be taken as financial advice. As the author, I am not a certified financial advisor, so I cannot give financial advice. It is strongly advised to consult with a licensed financial expert before making any financial investments.

Ammar has started several online businesses and is a blogger who loves providing quality content to help others. He is involved with affiliate marketing, domain names, NFTs, and cryptocurrencies. Check out my blog if you want to learn more about these areas and business in general.