BullionVault Review 2024: Is It Right For You?

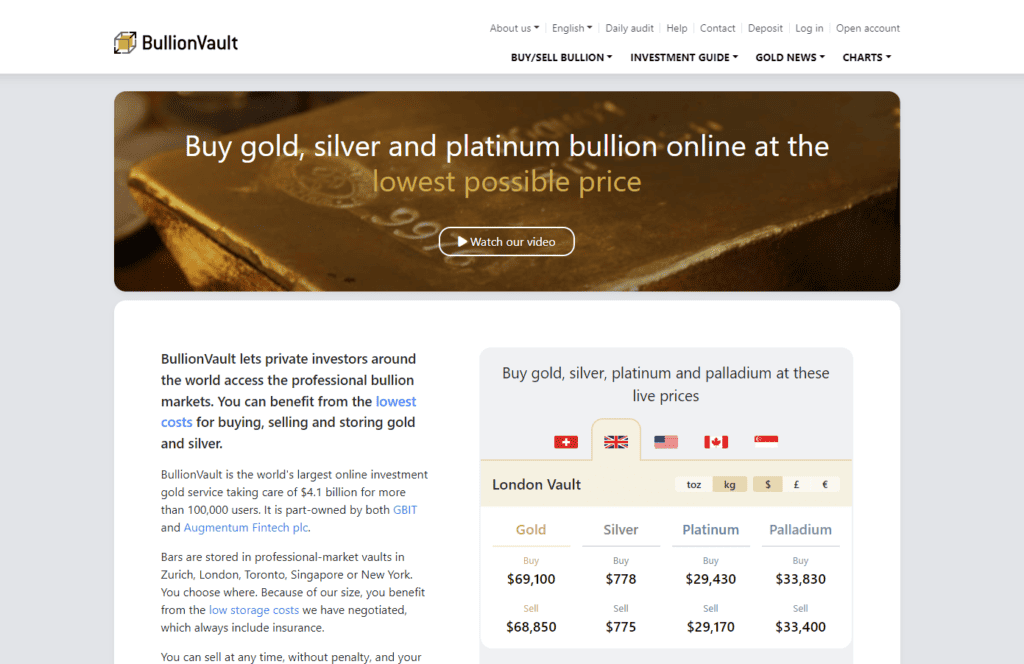

BullionVault is an online marketplace that allows individuals to buy, sell, and securely store physical gold, silver, platinum, and palladium. It acts as a bridge connecting investors with the world of physical precious metals, offering a convenient and secure alternative to traditional methods.

Who is BullionVault for?

This platform caters primarily to investors seeking to diversify their portfolios by incorporating tangible assets like precious metals. BullionVault is ideal for individuals who:

- Value security and peace of mind: BullionVault stores precious metals in insured vaults worldwide, offering robust security measures and eliminating the risks associated with physical storage at home.

- Seek convenience and flexibility: The online platform allows 24/7 access to buy, sell, and manage precious metal holdings, providing greater control and flexibility than traditional methods.

- Aim for cost-effectiveness: BullionVault generally offers competitive fees compared to traditional dealers, making it a cost-effective way to invest in precious metals.

Benefits of using BullionVault

- Enhanced security: BullionVault utilizes insured vaults managed by security specialists, offering peace of mind for investors concerned about the safekeeping of their precious metals.

- Convenience and flexibility: The online platform allows 24/7 access to manage your holdings, place orders, and track market movements.

- Cost-effectiveness: BullionVault offers competitive fees and transparent pricing, potentially reducing the cost of investing in precious metals compared to traditional methods.

- Transparency and quality: BullionVault provides detailed information about the origin and quality of the precious metals stored in their vaults, ensuring transparency and building trust with investors.

Risks of investing in precious metals

Acknowledging that investing in any asset, including precious metals, inherently carries risks is crucial. These risks include:

- Price fluctuations: Precious metals can be volatile, meaning their value can experience significant swings, potentially leading to losses.

- Market sensitivity: Precious metal prices can be impacted by various factors, such as economic conditions, global events, and currency fluctuations.

- Liquidity considerations: While BullionVault offers a platform for selling your holdings, the liquidity of precious metals might not be as readily available as some other investment options.

How BullionVault Works

Registration and Account Setup

- Signing Up: Visit the BullionVault website and click “Register” to create an account. The process requires basic information like name, email address, and desired username.

- Verification: BullionVault requires users to verify their identity and address by submitting relevant documents, such as passports and utility bills, to comply with regulations.

- Account Types: BullionVault offers two main account types:

- Individual Account: Suitable for personal investment purposes.

- Corporate Account: Designed for businesses and institutions. Each account type has specific requirements and features.

Buying and Selling Precious Metals

Funding your Account: Before buying, you must deposit funds into your BullionVault account using various methods, such as bank transfers, wire transfers, or debit/credit cards (depending on your location and account type).

Market Access: BullionVault offers access to two markets for buying and selling:

- Live Market: This service provides real-time prices based on supply and demand, allowing users to place market orders or limit orders.

- Order Board: This feature enables users to see existing buy and sell orders from other users and potentially match them at a mutually agreeable price.

BullionVault offers various order types, including:

- Market Order: The order gets executed immediately at the most favorable price possible.

- Limit Order: This type of order specifies a desired price for buying or selling, and it only executes if the market price reaches that level.

- Stop Order: This is similar to a limit order but triggers execution only if the price reaches a specific level to prevent further losses.

Fees: BullionVault charges various fees, including commissions, storage fees, and withdrawal fees. It is crucial to familiarize yourself with the fee structure before making any transactions.

Settlement: Once an order is filled, the platform automatically deducts funds from your account for buying or credits your account for selling. The purchased metal is then reflected in your vault holdings.

Storage and Security

Vault Network: BullionVault stores physical precious metals in insured vaults in various secure locations worldwide. Users can choose their preferred vault location based on their convenience.

Insurance: All metals stored in BullionVault vaults are insured against loss or damage. The platform’s website provides detailed information about insurance coverage.

Security Measures: BullionVault implements various security measures to protect user accounts and stored metals. These include:

- Two-factor authentication

- Secure data encryption

- Regular security audits

Delivery Options

Requesting Delivery: While BullionVault primarily focuses on secure storage, users can request the physical delivery of their precious metals to a secure facility or designated address for an additional fee.

Delivery Process: The delivery process involves fulfilling specific security protocols and may require additional documentation and insurance depending on the delivery location.

Costs and Procedures: BullionVault’s website provides detailed information about delivery fees, procedures, and lead times. Users are advised to carefully review these details before requesting delivery.

Account Management and Withdrawal Options

- Accessing your Account: Users can access their accounts online through the BullionVault website or the official BullionVault app.

- Account Dashboard: The dashboard overviews your account balance, current holdings, order history, and transaction statements.

- Withdrawing Metals: Users can request to withdraw their metals from storage at any time, subject to any fees and delivery procedures mentioned earlier.

Comparing BullionVault With Other Options

Traditional Methods

Physical Dealers:

- Advantages:

- Direct interaction: Potentially build relationships with knowledgeable dealers and receive personalized service.

- Immediate physical possession: Take immediate physical possession of purchased metals.

- Disadvantages:

- Limited selection: Certain metals or forms (bars, coins) may have limited availability.

- Security concerns: Ensure safe storage or consider insurance for physical holdings.

- Potential for higher premiums: Costs might be higher due to overheads and markups.

Coins:

- Advantages:

- Collector’s value: Certain coins hold collectible value beyond their metal content.

- Physical possession: Similar to physical dealers, immediate physical access to the metal.

- Disadvantages:

- Storage and security concerns: Similar concerns as with physical dealers.

- Liquidity challenges: Selling coins might be less convenient or incur higher fees than other options.

- Premiums can be significant: Coin prices often include significant premiums over the metal’s spot price.

Online Platforms

- Factors to Consider:

- Fees: Compare transaction fees, storage fees, and other associated costs across platforms.

- Security features: Evaluate the platform’s security measures, insurance coverage, and track record of safeguarding assets.

- Ease of use: Consider the user interface, trading platform functionality, and overall user experience.

- Reputation and customer support: Research the platform’s reputation, customer reviews, and quality of customer support.

Comparison with Similar Platforms

- Focus on a few key competitors: Select relevant online platforms to compare directly with BullionVault.

- Compare critical features: Analyze factors like supported metals, minimum investment amounts, available storage locations, and withdrawal options.

- Highlight unique features: Differentiate BullionVault by mentioning any unique features or services it offers compared to competitors.

- Maintain neutrality: Avoid presenting any platform as inherently better than the others.

Additional Considerations

- Liquidity: Compare the platforms in terms of their order book depth and overall liquidity for buying and selling metals.

- Regulation: Discuss each platform’s regulatory framework and any potential implications for investors.

- Investment goals: Remind readers that the choice of platform hinges on individual investment goals and risk tolerance.

FAQ:

What is the Minimum Investment Amount on BullionVault?

The minimum investment amount varies depending on the chosen metal and account type. BullionVault’s website provides detailed information on minimums for each option.

Which Currencies Does BullionVault Support?

BullionVault accepts various currencies for buying and selling precious metals, including significant currencies like USD, EUR, and GBP. You can also hold your metal holdings in grams or ounces.

How Does BullionVault Handle Taxes on my Precious Metal Investments?

Tax implications for precious metal investments can vary depending on location and circumstances. Please consult with a tax advisor to understand your specific tax obligations. BullionVault cannot provide tax advice and recommends seeking professional guidance.

What are the Fees Associated with Using BullionVault?

BullionVault charges fees for various services, including buying and selling, storage, and withdrawal. Their website offers a transparent breakdown of all expenses, allowing users to calculate potential costs before investing.

How do I Learn More About BullionVault and Investing in Precious Metals?

Here are some helpful resources:

- BullionVault website: https://www.bullionvault.com/

- BullionVault FAQs: https://www.bullionvault.com/help/FAQs/FAQs_whyBV.html

- Educational resources: BullionVault offers various educational materials on its website, including articles, guides, and webinars.

Summary

As we’ve explored, BullionVault offers a unique approach to acquiring and holding physical precious metals. Through its online platform, investors gain access to a secure and convenient way to diversify their portfolios with gold, silver, platinum, and palladium.

However, it’s crucial to remember that investing in any asset carries inherent risks. Precious metals are not immune to market volatility, and their value can experience significant swings. Therefore, thorough research and careful consideration are essential before making investment decisions.

Consulting with a financial advisor can provide valuable guidance and personalized recommendations tailored to your circumstances. You can also read about the best gold IRA companies here.

Ultimately, you decide whether BullionVault aligns with your investment strategy. Weighing the advantages of security, convenience, and diversification against the inherent risks involved allows you to make an informed choice.

If you decide to explore the world of precious metals, platforms like BullionVault can offer a streamlined and secure entry point. However, remember that building a robust investment strategy remains a personal journey requiring diligence, research, and sound financial planning.

Note: I am not a financial advisor. This should not be considered financial advise. Please do your own due diligence before proceeding.

Ammar has started several online businesses and is a blogger who loves providing quality content to help others. He is involved with affiliate marketing, domain names, NFTs, and cryptocurrencies. Check out my blog if you want to learn more about these areas and business in general.